Rhythmlink International LLC has announced a new investment partnership with Graham Partners, a Pennsylvania-based private equity firm specializing in industrial technology and advanced manufacturing businesses.

Rhythmlink, a designer and manufacturer of disposable neurodiagnostic devices, says in a press release that the investment from Graham Partners will facilitate its ongoing expansion efforts, building on the growth it has experienced since its founding in 2002.

“We’re excited about this next phase of Rhythmlink,” says Shawn Regan, Rhythmlink CEO and co-founder, in a press release. “Graham is an excellent partner for us because of their experience in medical technology and healthcare, and we see this as a growth opportunity for us to continue to innovate beyond our current capabilities. I’m extremely proud of how far we’ve come, and this is a chance for Rhythmlink to expand our business without sacrificing what matters to us: improving patient care in our field of neurodiagnostics.”

This new relationship with Graham follows Rhythmlink’s partnership with New Heritage Capital, a Boston-based private equity firm that invested in Rhythmlink in 2019. Under partnership with New Heritage, Rhythmlink experienced growth, acquired Chalgren Enterprises, and expanded its existing product line to include EMG and NCV diagnostic consumable devices.

“Our partnership with New Heritage was extremely beneficial,” says Joe Straczek, Rhythmlink COO and CFO, in a press release. “With their support, both financially and strategically, we were able to realize significant growth, particularly with the acquisition of Chalgren. We are immensely grateful for their partnership and guidance over the last four years.”

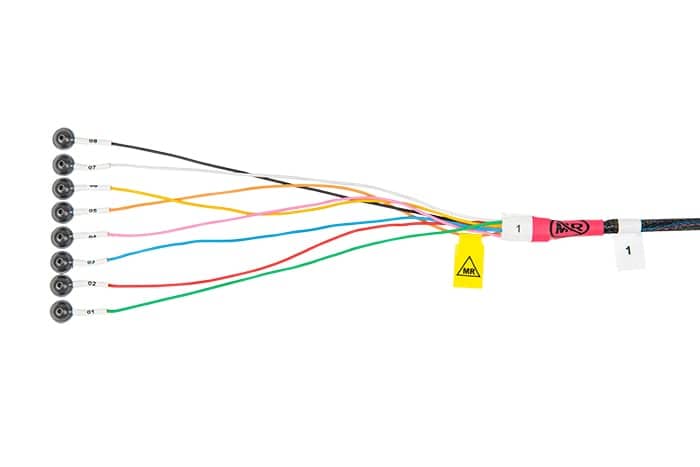

Rhythmlink sells a full line of consumable neurodiagnostic devices for critical care, electroencephalography, intraoperative neuromonitoring, the emergency room and intensive care unit, and long-term epilepsy monitoring.